Successful insurance sales rests heavily on strong customer relationships. You need to understand your customers’ needs and concerns to be able to direct them to the right insurance products, deliver excellent customer service, and grow your business.

Effective marketing strategies and consistent communication throughout every step of the customer journey is the foundation for your business growth. That’s why you need a CRM for insurance agents that’s designed specifically to foster positive customer interactions, improve your sales pipeline, and boost your marketing efforts

Why a CRM is essential for insurance agents

With a cloud-based customer relationship management (CRM) system, you’ll have a powerful yet easy-to-use tool to manage all your customer contacts and interactions in one place, and gain the client insights you need to provide the outstanding customer experience they expect.

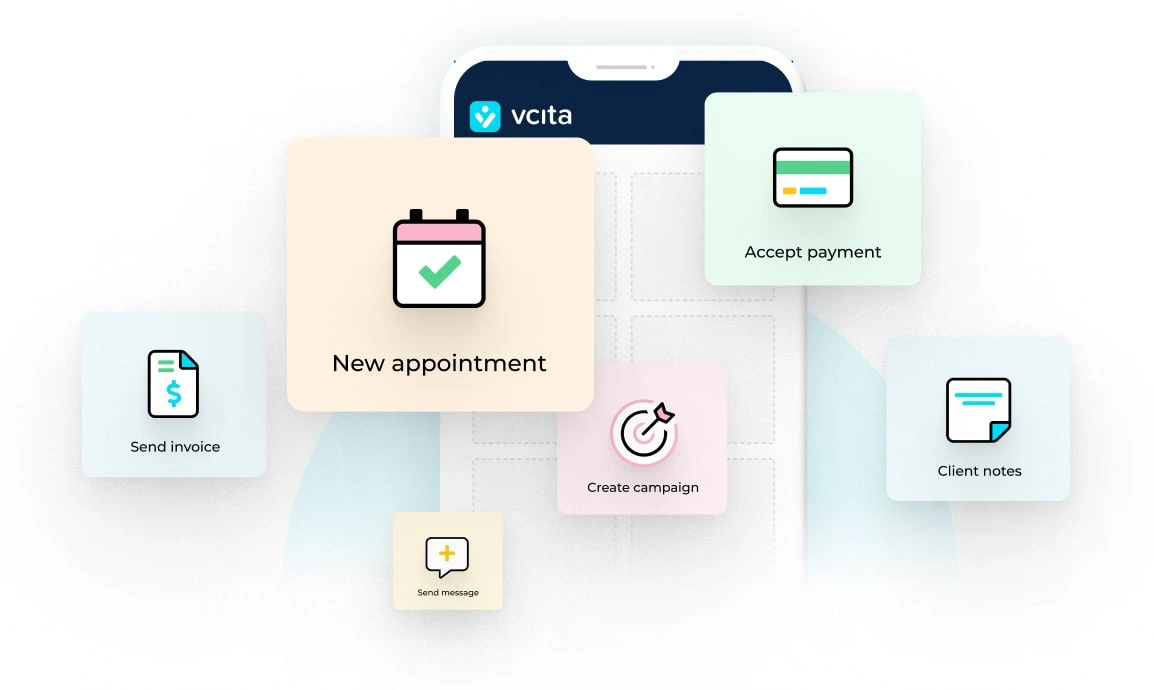

CRM software built for insurance agents, like vcita’s cloud-based CRM, streamlines your sales pipeline by keeping all your leads, clients, and opportunities in one place. It automates contact management, so you can focus on building real relationships, and gives you reminders about follow-ups and renewals so you never drop the ball. It’s essential for staying organized, boosting sales, and providing great customer service.

The key benefits of a CRM for insurance agents

Using a CRM for insurance agents provides several key benefits.

Full visibility into customers and prospects

First, a CRM for insurance agents gives you a 360-degree view of your customers and prospects, all in one place. You’ll have easy access to contact information, policy details, communication history, and more, enabling you to deliver a highly personalized customer experience.

Streamlined sales and marketing operations

With features like task management, email marketing, and call tracking, a CRM helps you save time on administrative work. Marketing automation capabilities allow you to nurture leads with automated email campaigns, newsletters, and drip campaigns to engage your contacts and move them through your sales pipeline.

Reliable account management

An insurance-specific CRM is important for staying on top of account management. It provides specialized tools for managing policies, claims, and renewals so you can provide the best service. Many also offer compliance and security features to keep sensitive customer data protected.

Mobility and flexibility

Cloud-based CRM software for insurance agents enables you to access customer information and manage your business from anywhere using any internet-enabled device. The software is maintained offsite so you avoid the cost and hassle of installing and updating the system yourself.

Sales pipeline tracking

A CRM gives you visibility into your sales pipeline and sales performance. See how much business you have in each stage, be it a prospect, lead, opportunity, or client. Identify trends to gain insight into what’s working, and make data-driven decisions to improve sales and revenue.

Improve Customer Experience

A CRM helps ensure a consistent, personalized experience for all your clients. Log service calls, claims, and any client interactions so you have a complete view of each customer relationship. Use this data to anticipate needs, address issues quickly, and strengthen loyalty.

The must-have CRM features that insurance agents should look for

As an insurance agent, having a solid CRM in place to manage your sales pipeline and marketing efforts can be the difference between barely staying afloat and thriving. You need an easy-to-use system with the core features to enhance customer relationships, streamline operations, and boost sales. Here are some must-have features to look for:

Contact management

A CRM lets you store all your client and prospect contact details in one place. You’ll have quick access to names, emails, phone numbers, policy details, and communication history. This makes it easy to stay up to date with customer needs and provide great customer support.

Lead management

An insurance CRM should allow you to capture leads from your website, email campaigns, social media, and more. It will automatically log the lead details and source so you can see what’s working, assign leads to agents, and track lead progress through your sales funnel.

Workflow automation

With workflow features, you can set up automatic lead routing, task reminders, and follow-ups. This helps ensure important prospects and clients don’t slip through the cracks. You’ll be able to see at a glance what needs to be done each day to keep your sales pipeline moving.

Reporting and analytics

A good insurance CRM will give you insight into key metrics like lead conversion rates, sales velocity, and customer retention. You’ll be able to see reports on lead sources, top-producing agents, and more. This data can help you make better decisions about how to improve your marketing and sales processes.

Multiple integrations

Look for a CRM that integrates with other tools you use, like email marketing services, proposal software, and accounting platforms. Integrations allow you to automatically sync data between systems, saving you time and reducing errors. With well-integrated tools, you’ll have a seamless solution to manage your entire insurance business.

Choosing the right CRM for your insurance business

When you set out to find a good CRM, look beyond core functionalities for these capabilities that can give your business a competitive edge.

Full accessibility to customer insights

Cloud software like vcita is accessible anywhere via the internet, so you and your team can log in from any device. This allows you to stay on top of leads and manage customer relationships whenever and wherever you go. Cloud CRMs are also cheaper and easier to set up, maintain, and keep up-to-date.

Manage sales and marketing in one place

An all-in-one CRM platform gives you a single solution to oversee both sales and marketing operations. You’ll have tools to nurture leads, build personalized marketing campaigns, provide top-notch customer support, and analyze data to gain insights into what’s working. Integrating these functions into your CRM helps break down silos between teams and gives you a holistic view of your customers’ experiences.

Focus on the customer experience

At its core, a good CRM helps you strengthen customer relationships by giving you a means to better understand and engage with them. Look for a solution with advanced features that enhance the customer experience, such as customer support options. The ability to capture detailed customer profiles, track interactions, and personalize communications will set you apart in the insurance industry.

With many CRM options for insurance agents, look for one that fits your needs and budget. A CRM tailored to the insurance industry may have useful integrations and workflows built into the platform. Take advantage of free trials to find what works best for your insurance business.

How to optimize your sales pipeline with CRM software

Once you’ve acquired the right CRM for your insurance agency, you need to make the most of it. Here are the main ways to use your new insurance agent CRM solution to refine your sales and marketing activities and drive more revenue.

-

Track your sales pipeline

Use your CRM as a centralized place where you log communications, appointments, quotes, and deals for each of your prospects and clients. With this data, you can better forecast sales and revenue to keep your insurance business growing.

-

Nurture leads and boost sales

Apply your CRM’s marketing automation features like drip email campaigns, social media integration, and landing pages to stay in regular contact with leads and guide them to becoming customers. For example, set up an email series to educate new leads on different policy options, or promote an insurance offer on social media and capture leads with a landing page.

-

Improve customer experience

Leverage your CRM to provide personalized customer service. Log details like a client’s coverage, claims, payments and communication history in their contact profile, then reference important dates, life events or policy changes anytime they reach out with a question or issue. Strong customer relationships and experiences build loyalty, leading to more referrals and repeat business.

In summary, CRM software is a must-have for enhancing your sales pipeline and marketing as an insurance agent. The right platform will help you boost lead conversion, strengthen customer loyalty and ultimately, grow your book of business. With an optimized CRM in place, you’ll gain valuable insights to set and achieve your sales targets.

A CRM can drive success for insurance agencies

For insurance agents, a CRM is the key to running an efficient, profitable business in today’s competitive insurance industry. Using a CRM tailored to insurance agents, with tools to unify your sales and marketing teams around customer relationships, can help boost sales, enhance your marketing, and improve the customer experience. With the right solution in place, you’ll provide amazing experiences, boost sales productivity, and gain valuable insights to fuel your agency’s growth.