What kind of freelancer are you?

Writer? Designer? An accountant besieged by clients at tax time?

Whatever your expertise, you’re running a business. To maintain the freedom and independence you love, you need to maintain a steady cash flow. In other words, keep the work coming in- and invoicing for it promptly.

This is where a solid invoicing system can help. Even if your answer to the question above was ‘accountant’, simplifying the billing process will leave you with more time to grow your business. Fortunately, you have a lot of options. Now let’s look at the best ones, along with some solid practices that keep those payments coming in.

How to invoice as a freelancer and what to include in your invoice

When you loan money to a friend, an IOU is fine. When you’re billing a client, you need to supply a lot more detail.

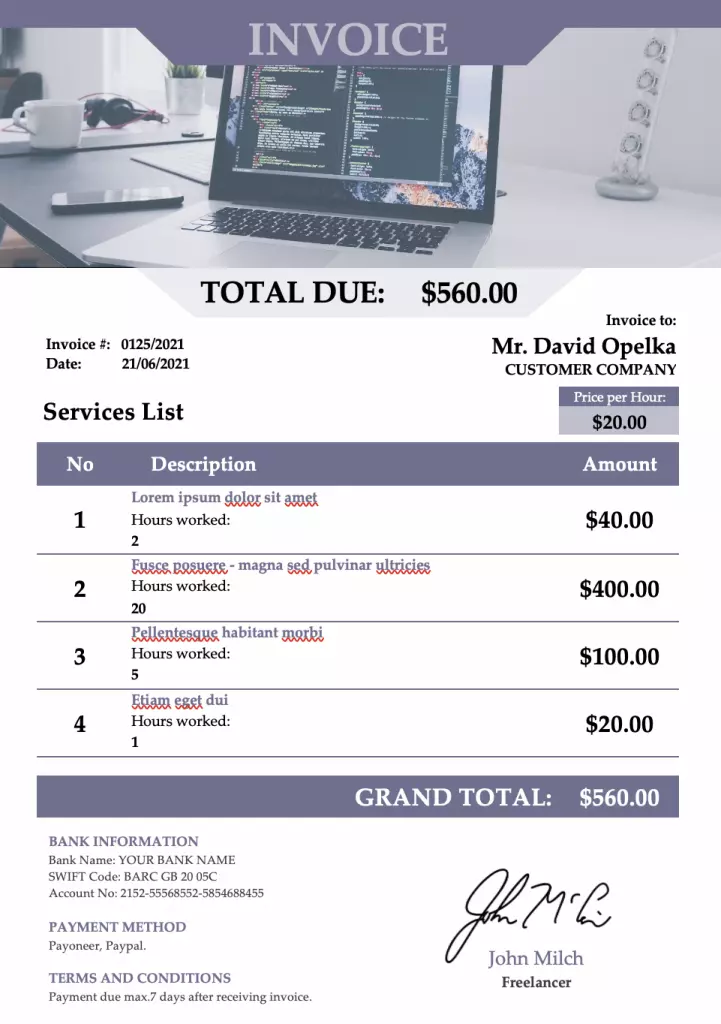

If you do your own invoicing, here’s a checklist for making it as thorough as possible:

- Clearly state that the document is an actual invoice, so that it isn’t mistaken for a quote or proforma invoice. Insert the word ‘INVOICE’ in all-caps at the top of the page.

- Include your business’s name and unique identification number, along with your address and contact information.

- Provide the name and address of your customer. This should be the address where you sent their order.

- Include a description of the goods or services provided and how many units. If you sell an hourly service, note the hours. The more detail you provide, the less time you’ll spend responding to confused emails!

- Indicate the price per unit or service. Make sure there’s a separate line for each one.

- Include the invoice date and payment terms (e.g., Net 30 days)

- If you’re registered to collect taxes (e.g., VAT, state, provincial, or federal tax), you must include your tax number on your invoices and follow all applicable rules. Even if you’re selling exempt or zero-rated products or services, you have to state on the invoice that there are no taxes due.

How to invoice as a freelancer? 3 ways

When it comes to invoices, managing them is just as important as knowing what to include. Most freelancers use one of the following options.

Manual invoicing for freelancers

Invoice templates are a great way to start your business off on the right foot and keep it there. Freelancers can find invoice templates for Google Docs, Google Sheets here, or browse through the MS Excel Invoice Template for customized and appropriate invoicing.

If you’ve got the time to do that, great! But if you’re busy growing your business, these invoice templates from vcita are customized particularly to freelancers and cover a wide range of business types. You’ll find Excel and Word invoice templates specially designed for:

- Service providers

- Consultants

- Freelancers (yay!)

- Photographers

- Graphic designers

- And more!

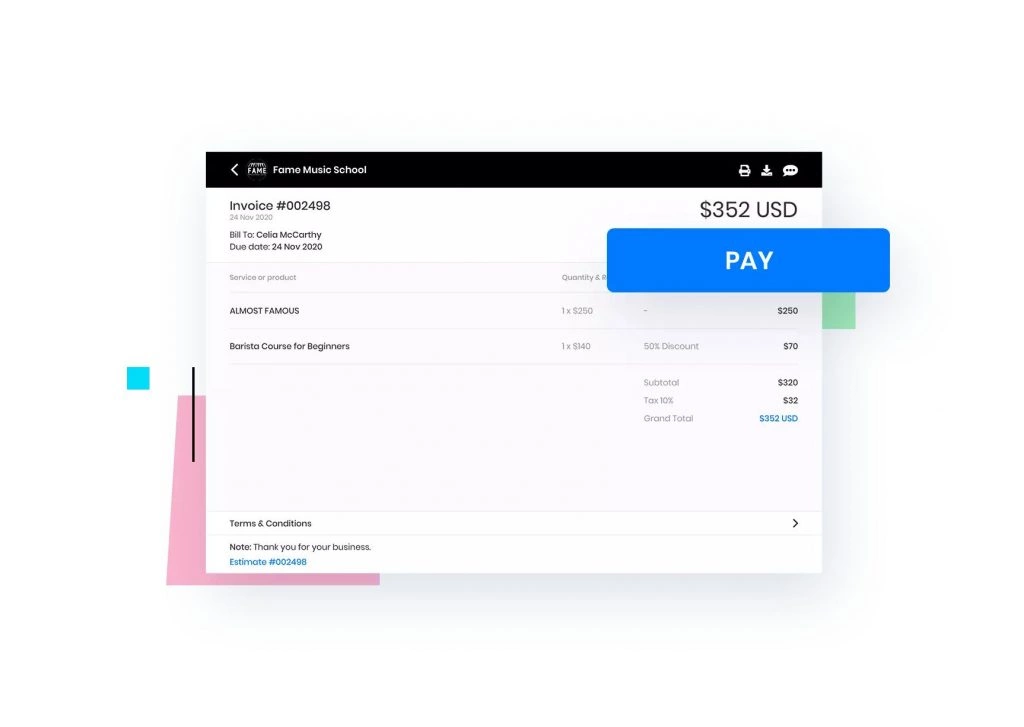

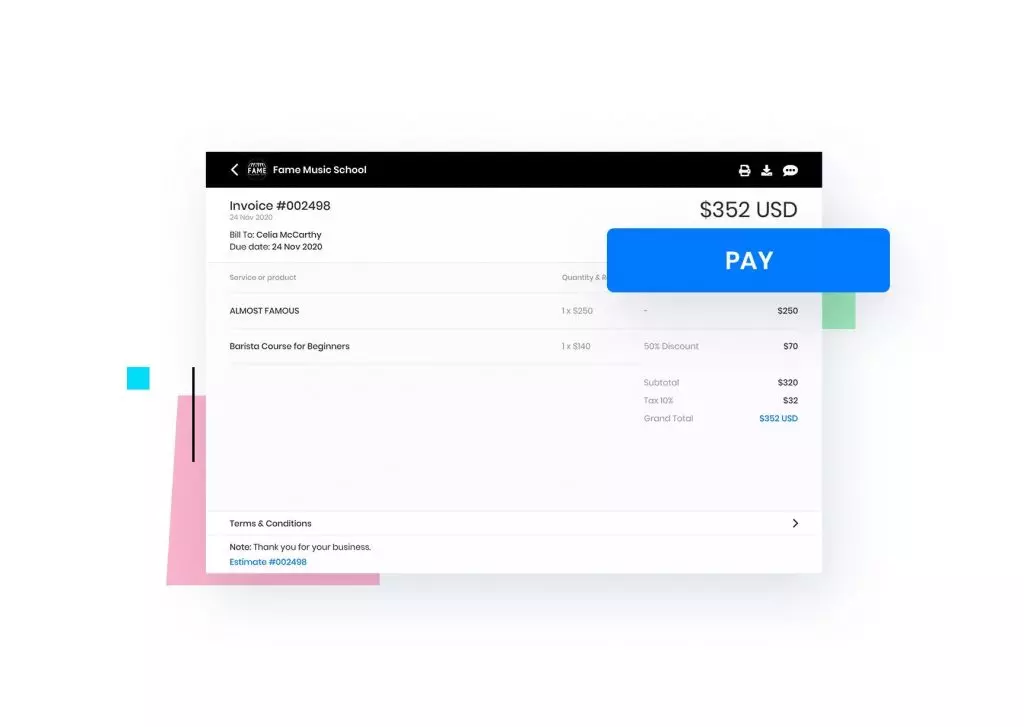

If you’ve just launched your freelance business and want to keep things as simple as possible, vcita even has an invoice template with a built-in payment option. Once you sign up, you’re connected to vcita’s payment gateway and can send the completed invoice off to your client, complete with a super-convenient ‘pay’ button.

What can be easier than that?

Hire an accountant

Many freelancers are strictly creative or hands-on and would rather leave the financial responsibilities to the pros. If that sounds like you, hiring an accountant is a smart move that will-

- Keep your customers happy

- Keep you on the good side of the tax authorities

Unless you have a knack for finances, you’ll want to have an accountant on retainer to do your taxes. While many freelancers use tax preparation software, not all of these solutions address your unique tax needs.

Let’s assume you live in the US. When you were an employee, you only had a single W2 form to worry about. As a freelancer, you’ve got to deal with:

- Multiple 1099s

- Business expense receipts

- A Schedule C for tracking profit and loss

An accountant can keep your finances on solid ground by estimating your quarterly tax payments, ensuring you benefit from all applicable business tax deductions and, if necessary, setting up an invoicing template with all the required fields for your industry.

A word of advice: if you’re looking to engage an accountant, don’t leave it until the month before taxes are due. The best professionals will be super-busy and not likely to consider new clients until the rush dies down. Start as soon as possible, ideally a few months before year-end.

Automatic Invoicing (software)

At one time, invoicing software was pretty generic. You received basic tools that had to be modified for your business. Today, you can find solutions tailored for individual professions, including freelancers!

One of the most popular examples is this billing and invoicing software by vcita. Specially designed to meet the needs of freelancers and small businesses, you can use it to:

- Send estimates, invoices, and receipts by email and SMS

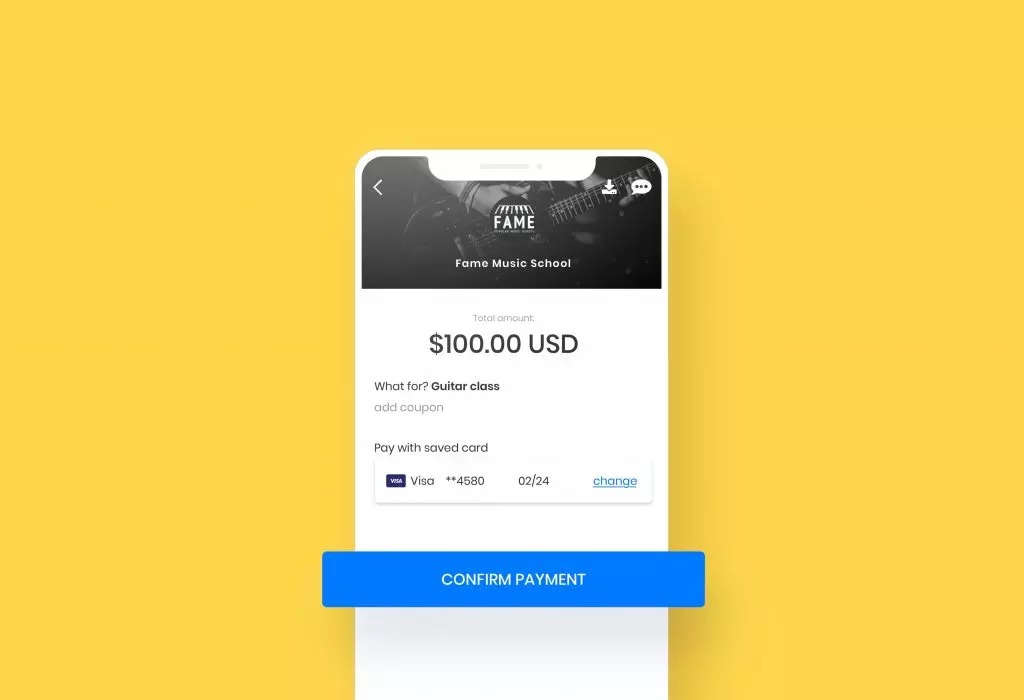

- Let clients pay directly from the invoice by mobile (SMS/email)

- Send automatic payment reminders

There are several invoice templates to choose from, each one 100% customizable. You can:

- Add your company name and logo

- Set your currency and tax rate

- Insert product or service descriptions

- Include a ‘pay now’ button that connects directly to a payment gateway

For added convenience, the dashboard has a simplified overview of paid, pending, and overdue invoices- no more wasting time running reports and following up. You have everything you need to manage your financials- no CPA designation required!

Make sure you get paid fast

When you’re running your own business, getting paid on time is critical. Clients who pay late can harm your cash flow, and chasing them down takes your focus away from your work.

So what can you do to keep the ‘past due’ pile to a minimum?

Set clear payment terms

Make sure that all new clients understand your payment terms before you ship anything or do any work. You can also include these terms on estimates and pro forma invoices.

Ask for a deposit

With new clients, especially ones that haven’t been referred by someone you know, you might want to consider getting payment upfront, especially for higher-priced goods or services. Many freelancers ask for a 50% deposit, which is an effective way of weeding out which clients are serious and which ones are likely to cause payment problems later.

Send reminders

If a client is late in paying, payment reminders usually work. Set up your invoicing software to send one email or SMS reminder 24 hours after the invoice comes due and another a few days later. This way, you don’t have to personally follow up with late-paying clients until it’s clear that there’s a problem.

Payment reminders should include:

- A clear subject line

- Summary of payment terms

- Details on how to pay

- A ‘Pay Now’ button for quick and convenient online payment

Offer flexible payment options

The easier it is for your clients to pay an invoice, the faster you will receive payment. The best billing and invoicing platforms can connect the client directly to a payment processor and let them pay by credit card, PayPal, or any other accepted payment methods. A few clicks, and your money is on its way!

Sign contracts

While signing a contract won’t guarantee prompt payment, it gives you legal recourse if the client doesn’t pay.

Your contract should include the following:

- Pricing and how that pricing is calculated. For example, are you charging an hourly rate or a flat fee for the entire project?

- Payment schedule and what forms of payment you accept.

- Product or service delivery deadlines.

- Terms and conditions.

- A cancellation fee (if the project is terminated for some reason).

- Copyright information.

A professionally-drafted contract that clarifies all terms of your working agreement upfront can prevent future issues. As the saying goes, “Get it in writing.”

Send invoices automatically

As a freelancer, your time is money. A digital invoicing platform like vcita will bring in payments a lot more quickly than going the old-fashioned postal route. (Plus, nothing will get lost in the mail!) If you have repeat clients who either pay a monthly retainer or place the same order every week or month, you can use this software to automatically send scheduled invoices.

Set up a tracking system for your invoices

As your business grows, you will be sending out more and more invoices. But that’s not all- you’re also going to have to track them to see which ones are paid and which ones are overdue.

While you can do this manually by assigning a number to each invoice and tracking it in a spreadsheet, it’s going to be more time-consuming as your client base expands. The best solution is an invoicing software that manages these details for you so that it only takes a few seconds to see where you stand financially.

What’s the bottom line?

When you’re self-employed, invoicing issues are an occupational hazard: an estimated 71% of freelancers have reported payment problems at some point in their career. Having a well-established and user-friendly invoicing system can significantly reduce this issue and leave you with more time to do what you do best.